看來,美國各州(地方政府)發行的債券(municipal bond),恐怕不是一時可以解決危機的,連Vanguard這種深受長期投資信徒擁戴的基金巨頭,也鑒於時勢,時不我予,決定暫緩3檔市政債券指數型基金與ETF的發行,還特別做了一個研究報告,想證明美國加州的情況跟希臘是不一樣的。

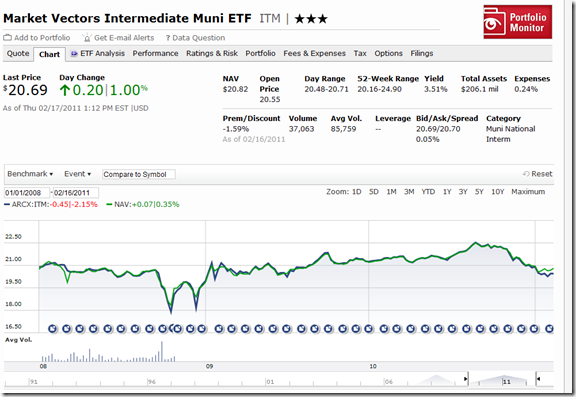

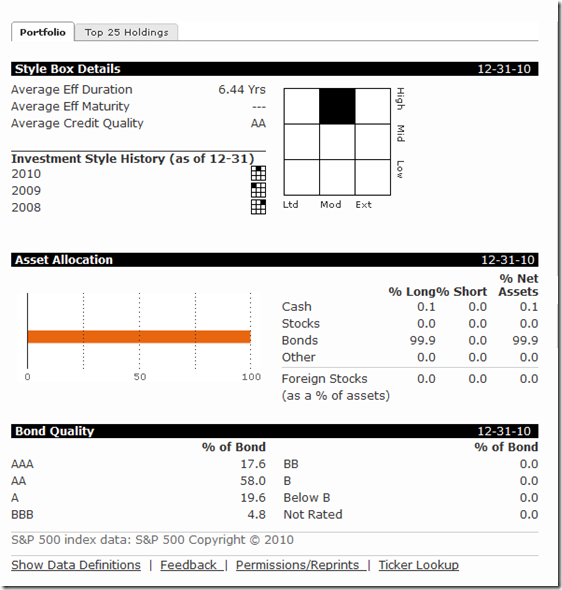

我找了一檔Market Vectors發行的中期市政債券ETF,可以看到其淨值明顯下跌,幅度僅次於2008年金融海嘯發生當時,這檔債券ETF平均的債信評等是AA,還算是相當穩健,只是投資人的擔心也是有道理的,信用評等公司在2008年所造成的風暴,大大折損了他們的威信。

如果真再有一次像2008年的信用危機,那麼將是投資人一個千載難逢(其實距上次好買點也才2年多)的買入時點。不過就像所有指數化投資專家說的一樣,適度的分散投資,仍然是最聰明的選擇。

Our municipal bond ETF launch has been postponed

Vanguard | 01/21/2011

In response to the exceptional volatility of the municipal bond market, we've withdrawn our SEC filing for three municipal bond index funds, effective January 13, 2011. The funds were expected to offer ETF and Admiral Shares and be available for investment in 2011.

We are firmly committed to offering only best-in-class investment products that can help you meet your client portfolio allocation needs. So, after very careful consideration, Vanguard determined that introducing new municipal bond investments in a persistently unstable municipal market would not be in your best interest or the best interests of your clients.

Please note that the filing has been withdrawn to avoid launching the funds in an environment that we believe will likely impede their ability to track their respective benchmarks. However, this does not suggest that you advise clients not to invest municipal bonds or municipal bond mutual funds that may be appropriate for their particular investment objectives.

Review our latest research which explains why we believe the doomsday headlines regarding the municipal bond market overreach reality.

We will continue to monitor the market and anticipate refiling with the SEC when the municipal bond market stabilizes. In the meantime, we encourage you to contact your Vanguard sales representative with any questions you may have.

B

4 意見:

版大您好~目前Fed的極低利率連葛洛斯都已經著手放空美債,小弟準備長期投資而持有的債劵ETF正是純美債的IEF,請問您覺得我該轉換標的嗎?換成全球政府債BWX或是新興市場債?感謝您~

我的留言系統有點小問題,今天才看到您的留言,十分抱歉。

如果你擔心美債,那表示你的債券配置不夠分散,選擇全球政府債也是一個選項,主要還是要考量你買債券的目的是什麼?

不過這幾年非美債和股票的關連性看起來還蠻高的,可能是受到美元匯率變化的影響,多過利率的影響,而且非美債 ETF 的費用率也偏高:似乎債券市場現在並沒有什麼特別好的選擇

張貼留言